| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

April 28, 202329, 2024

Dear Fellow Stockholders:

In 2022,2023, we made significant progress in fulfilling our mission of digitizingto digitize one of the most-importantmost important industries in the world. Xometry’s growth initiatives drove record results with revenue of $463 million including 30% marketplace revenue growth in a period of contraction in US manufacturing. We continuedfurther expanded marketplace gross margin by 260 basis points to expand30.8% powered by our proprietary AI algorithms and enhancerapid expansion in our global online marketplace,active supplier network.

Concurrently, we made significant investments in product development and technology infrastructure. We now offer tools including Teamspace and Workcenter to digitize work for both buyers and suppliers as well as provide software and information for customers to improve decision making and increase efficiency.

We are rapidly expandedgaining market share and remain confident in our buyer and supplier networks and introduced new products and services for our customers.long-term growth initiatives:

| • | Rapidly expanding our network of buyers and suppliers. We rapidly expanded our buyer and supplier networks globally, further enlarging our competitive moat. Active Buyers increased 36% to over 55,000 and Active Suppliers increased 36% year-over-year to 3,429. |

| • | Driving deeper Enterprise engagement. We invested in our enterprise sales efforts in 2023 and are making progress with Fortune 500 companies as they look for a technology partner to help manage dispersed, fragmented and complex supply chains. Our investments in our sales team drove progress in our enterprise strategy as Accounts with Last Twelve Months Spend of at Least $50,000 growing 30% year-over-year. |

| • | Expanding the marketplace menu. We significantly expanded our marketplace menu including new processes, materials, finishes and certifications enabling us to increasingly serve as our customers’ one-stop destination. We saw strong growth in production work, including our revamped injection molding offering. |

| • | Growing Internationally. We delivered 81% international revenue growth to over $60 million in 2023, scaling rapidly from $3 million in 2020 and now accounting for approximately 15% of total marketplace revenue. Through Xometry.eu, Xometry.uk and Xometry.asia, we have leveraged Xometry’s core technology to provide localized marketplaces in 14 different languages with networks of suppliers across Europe and Asia, as well as North America. |

| • | Enhancing Supplier Service solutions. We are enhancing supplier services including modernizing the Thomas advertising platform. We are focused on making it easier for suppliers to start and benefit from their advertising on Thomasnet. We also continue to enhance Workcenter, the digital operating system for manufacturers, by reducing the effort required to accomplish their daily tasks. |

Our AI-driven global marketplace is playing an instrumental role in helping buyers create locally resilient supply chains and manufacturers grow their businesses. The shift to digital, which has happened in so many other industries, is inevitable in custom manufacturing.

We are proud of what we accomplished in 2022,2023, and our team continues to work diligently to deliver comprehensive solutions that benefit buyers and suppliers.

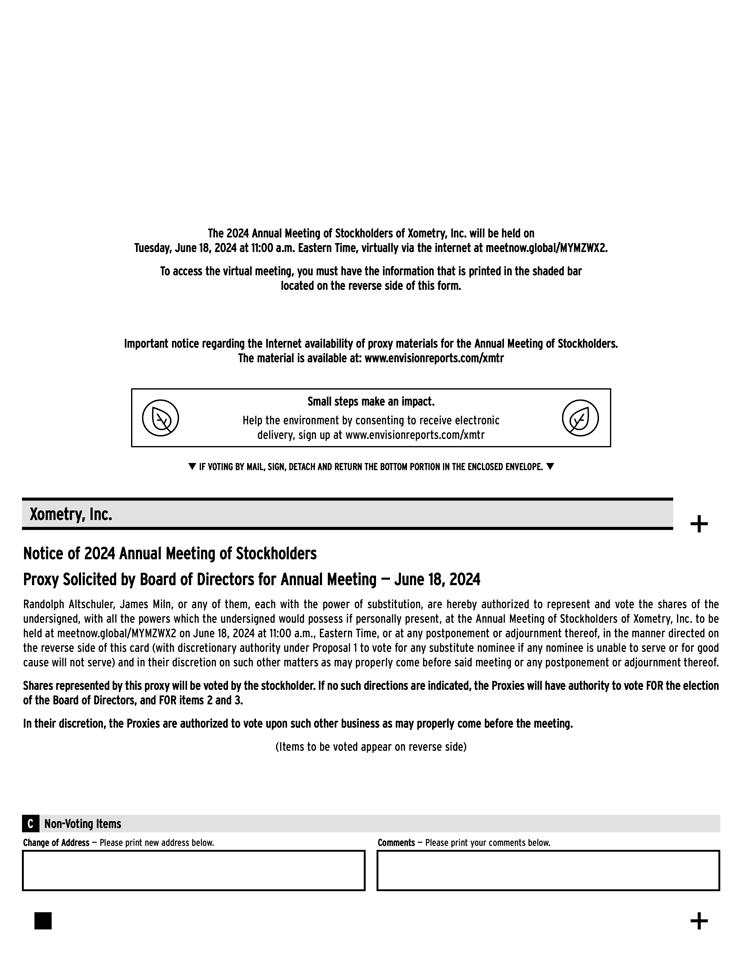

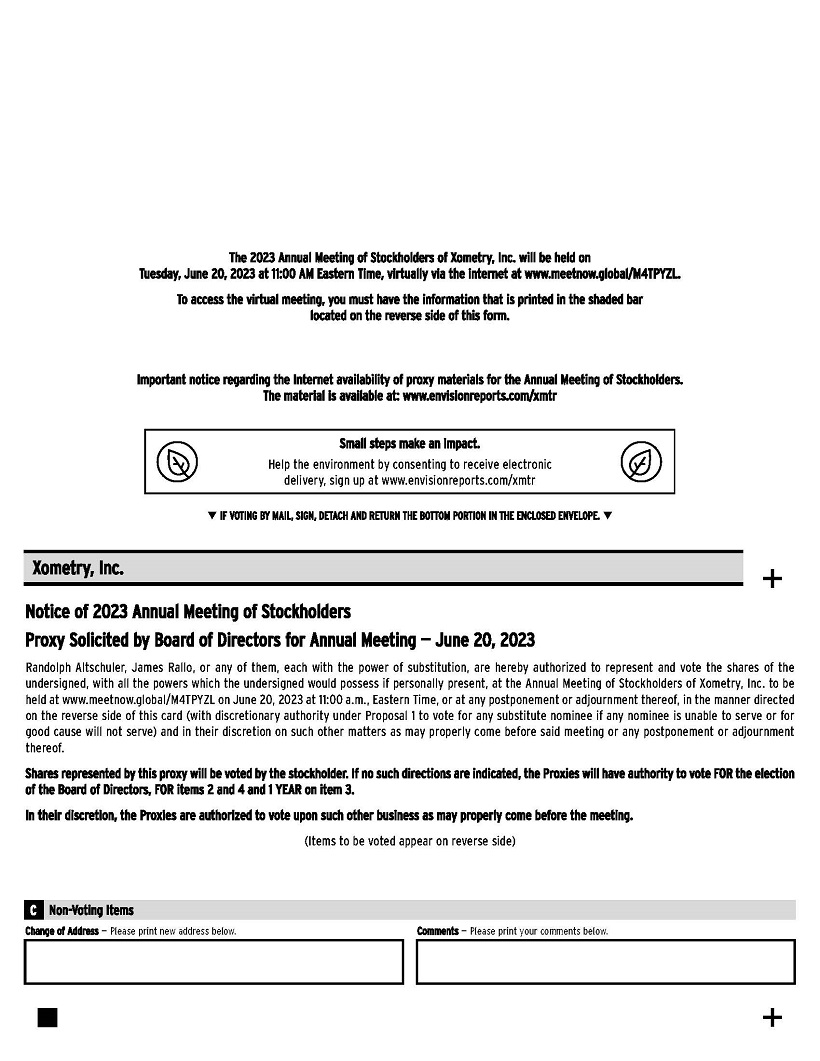

We are pleased to invite you to attend the 20232024 Annual Meeting of Stockholders of Xometry, Inc., a Delaware corporation (“Xometry”) to be held virtually on June 20, 202318, 2024 at 11:00 a.m., Eastern Time. To provide expanded access from locations around the world and to lower costs, we are continuing with a virtual format for our 20232024 Annual Meeting, which will be held solely online via live webcast. There will not be a physical location for the Annual Meeting, and you will not be able to attend the Annual Meeting in person.

You will be able to attend the Annual Meeting, ask your questions and vote your shares during the meeting by visiting https://meetnow.global/M4TPYZLMYMZWX2 and entering the control number located on the Notice of Internet Availability of Proxy Materials for the 20232024 Annual Meeting of Stockholders, your proxy card or voting instruction form. Additional details regarding access to the Annual Meeting and the business to be conducted at the Annual Meeting are described in the accompanying Notice of 20232024 Annual Meeting of Stockholders and proxy statement. Please note that supported browsers include Chrome, MS Edge, Firefox and Safari.

We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy statement and our 20222023 Annual Report. The notice contains instructions on how to access those documents over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 20222023 Annual Report and a form of proxy card or voting instruction form. We believe that providing our proxy materials over the Internet increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact and cost of our Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or, if you receive a paper proxy card by mail, by completing and returning the proxy card or voting instruction form mailed to you. Please carefully review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials you received in the mail.

On behalf of the Xometry Board of Directors and employees, we thank you for your continued support and look forward to speaking with you at the Annual Meeting.

Sincerely,

Randy Altschuler

Chief Executive Officer

XOMETRY, INC.

6116 Executive Boulevard

Suite 800

North Bethesda, Maryland 20852

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: | June | |

| Time: | 11:00 a.m., Eastern Time | |

| Location: | The Annual Meeting can be accessed by visiting https://meetnow.global/ | |

| Record Date: | The Record Date for the Annual Meeting is April

Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement. | |

| Items of Business: | The Annual Meeting will be held for the following purposes, which are more fully described in the proxy statement accompanying this Notice:

(1) To elect the Board of Directors’

(2) To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the proxy statement accompanying this Notice.

(3) To

Your vote is important. Whether or not you expect to attend the virtual Annual Meeting, please vote by telephone or through the Internet, or, if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you, as promptly as possible to ensure your representation at the Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you receive a paper proxy card by mail, the instructions are printed on your proxy card and included in the accompanying Proxy Statement. | |

| Even if you have voted by proxy, you may still vote online during the Annual Meeting. Please note, however, that if your shares are held of record by a brokerage firm, bank or other agent and you wish to vote online at the Annual Meeting, you must obtain a proxy issued in your name from that agent to vote your shares that are held in such agent’s name and account. |

Sincerely, |

|

Kristie Scott |

General Counsel and Secretary |

North Bethesda, Maryland |

April |

TABLE OF CONTENTS

| Page | |||||||

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | 1 | ||||||

| 9 | |||||||

INFORMATION ABOUT OUR DIRECTOR NOMINEES AND CURRENT DIRECTORS | 11 | ||||||

| 14 | |||||||

| 22 | |||||||

| 23 | |||||||

| 24 | |||||||

| 42 | |||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |||||||

i

GENERAL INFORMATION

XOMETRY, INC.

6116 Executive Boulevard

Suite 800

North Bethesda, Maryland 20852

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a Notice of Internet Availability of Proxy Materials on the internet instead of a full set of Proxy Materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our Proxy Materials (as defined below) over the Internet. Accordingly, we have sent you a Notice of Internet Availability because the Board of Directors of Xometry, Inc. (the “Board”) is soliciting your proxy to vote at the 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) of Xometry, Inc., including at any adjournments or postponements thereof, to be held on Tuesday, June 20, 202318, 2024 at 11:00 a.m., Eastern Time. The Annual Meeting can be accessed by visiting https://meetnow.global/M4TPYZL MYMZWX2. Please note that supported browsers include Chrome, MS Edge, Firefox and Safari.

The Notice of 20232024 Annual Meeting of Stockholders (“Notice of Annual Meeting”), this proxy statement, the proxy card or voting instruction form, and our Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 (the “Annual Report” and, together with the proxy statement and proxy card or voting instruction form, the “Proxy Materials”) are available to stockholders on the Internet.

The Notice of Internet Availability will provide instructions as to how a stockholder of record may access and review the Proxy Materials on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the Proxy Materials, including a proxy card, be sent by mail or email to the stockholder of record. The Notice of Internet Availability will also provide voting instructions. Please note that, while our Proxy Materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Annual Meeting, proxy statement and Annual Report are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document.

We intend to mail the Notice of Internet Availability on or about May 8, 20236, 2024 to all stockholders of record entitled to vote at the Annual Meeting. The Proxy Materials will be made available to stockholders on the Internet on the same date.

In this proxy statement, we refer to Xometry, Inc. as “Xometry,” “we” or “us.”

Will I receive any other Proxy Materials by mail?

You will not receive any additional Proxy Materials via mail unless you request a printed copy of the Proxy Materials in accordance with the instructions set forth in the Notice of Internet Availability.

When is the record date for the Annual Meeting?

The Board has fixed the record date for the Annual Meeting as of the close of business on April 26, 202324, 2024 (the “Record Date”).

How do I attend the Annual Meeting?

We will be hosting the Annual Meeting via live webcast only. You are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on the Record Date, or if you hold a valid proxy for the meeting. There will not be a physical location for the Annual Meeting, and you will not be able to attend the Annual Meeting in person.

1

The Annual Meeting will begin promptly at 11:00 a.m., Eastern Time, on Tuesday, June 20, 2023.18, 2024. To participate in the Annual Meeting, you will need to visit https://meetnow.global/M4TPYZLMYMZWX2 and enter the control number included on your Notice of Internet Availability, on your proxy card or on the instructions that accompanied your proxy materials, as applicable. If your shares are held by a broker, use the control number provided by your broker found on your notice or voting instruction form.

We recommend that you log in a few minutes before the Annual Meeting to ensure that you are logged in when the meeting starts. Please follow the registration instructions as outlined in this proxy statement. Information on how to vote online during the Annual Meeting is discussed below.

What do I do if I have technical difficulties in connection with the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted at https://meetnow.global/M4TPYZLMYMZWX2. Technical support will be available starting at 7:00 a.m., Eastern Time, on June 20, 2023.18, 2024.

How do I register to attend the Annual Meeting?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare Trust Company, N.A. (“Computershare”)), you do not need to register to attend the Annual Meeting. Please follow the instructions on the notice or proxy card that you received to join the Annual Meeting.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting or to vote or ask questions during the Annual Meeting.

To register to attend the Annual Meeting you must submit proof of your proxy power (“Legal Proxy”) reflecting your holdings in our capital stock along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 15, 2023.13, 2024. You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to Computershare as follows:

| By email: | Forward the email from your broker granting you a Legal Proxy, or attach an image of | ||

| your Legal Proxy, to legalproxy@computershare.com. | |||

| By mail: | Computershare Trust Company, N.A. | ||

| Xometry Legal Proxy | |||

| P.O. Box 43001 | |||

| Providence, RI 02940-3001 | |||

How do I ask a question at the Annual Meeting?

Only stockholders of record as of the Record Date may submit questions or comments that may be addressed during the Annual Meeting. If you would like to submit a question, you may do so by going to https://meetnow.global/M4TPYZLMYMZWX2 and entering the control number included on your Notice of Internet Availability, on your proxy card or on the instructions that accompanied your proxy materials, as applicable. If your shares are held by a broker, use the control number provided by your broker found on your notice or voting instruction form.

In accordance with the rules of conduct, we ask that you limit your questions to questions that are relevant to the Annual Meeting or our business and that such questions are respectful of your fellow stockholders and

2

meeting participants. Questions and answers may be grouped by topic, and substantially similar questions may be

2

grouped and answered once. In addition, questions may be ruled out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the stockholder’s own personal, political or business interests.

Will a list of record stockholders as of the record date be available?

A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours by any stockholder for any purpose germane to the meeting for the ten days ending the day prior to the meeting at our offices. Please email legal@xometry.com to arrange for an in-person examination. The stockholder list will also be available electronically during the meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote online during the Annual Meeting. On the Record Date, there were 45,167,42146,122,020 shares of Class A common stock and 2,676,154 shares of Class B common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with Computershare, then you are a stockholder of record. As a stockholder of record, you may vote online during the meeting by going to https://meetnow.global/M4TPYZLMYMZWX2 and entering the control number included on your Notice of Internet Availability, on your proxy card or on the instructions that accompanied your proxy materials, as applicable. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If, on the Record Date, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability is beingshould be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you must follow the instructions provided by your brokerage firm, bank or other similar organization for your bank, broker or other stockholder of record to vote your shares per your instructions. Alternatively, many brokers and banks provide the means to grant proxies or otherwise instruct them to vote your shares by telephone and via the internet, including by providing you with a control number via email or on your notice or your voting instruction form. If your shares are held in an account with a broker, bank or other stockholder of record providing such a service, you may instruct them to vote your shares by telephone (by calling the number provided in the Proxy Materials) or over the internet as instructed by your broker, bank or other stockholder of record. If you did not receive a control number via email or on your notice or voting instruction form and you wish to vote prior to or at the virtual Annual Meeting, you must follow the instructions from your broker, bank or other stockholder of record, including any requirement to obtain a valid legal proxy. Many brokers, banks and other stockholders of record allow a beneficial owner to obtain a valid legal proxy either online or by mail, and we recommend you contact your broker, bank or other stockholder of record to do so. You may not vote your shares online during the meeting unless you request and obtain a valid proxy from your broker or other agent, as required.

What am I voting on?

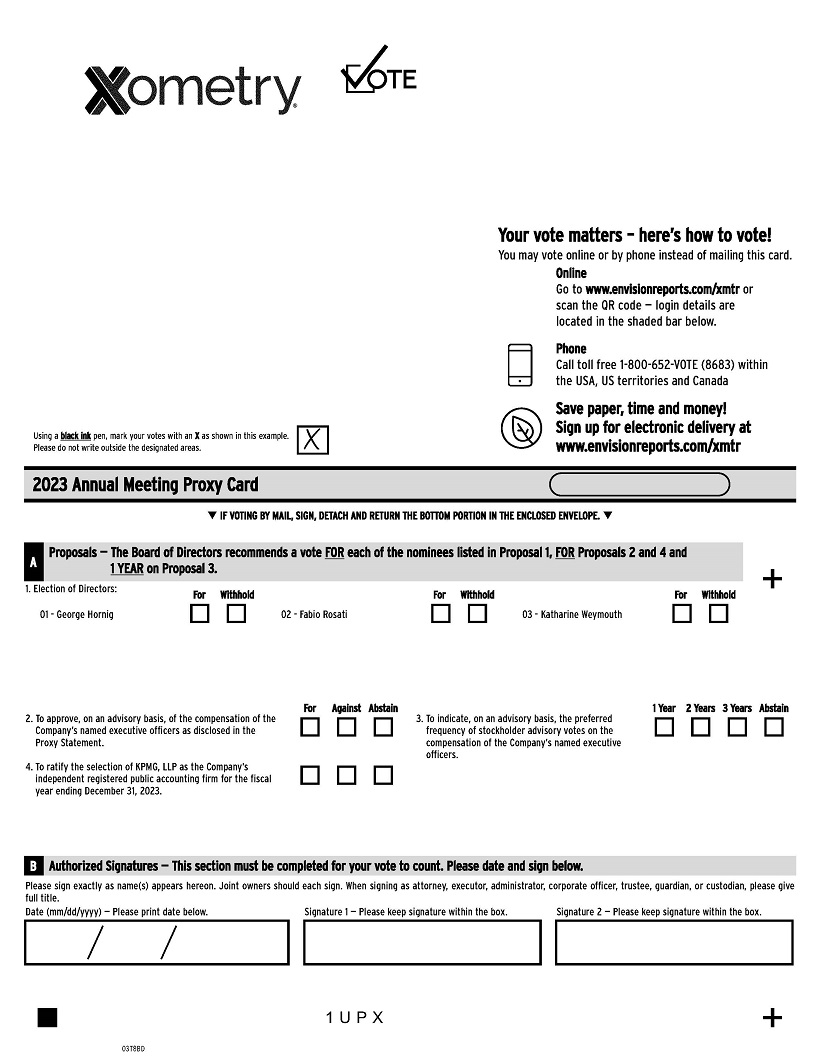

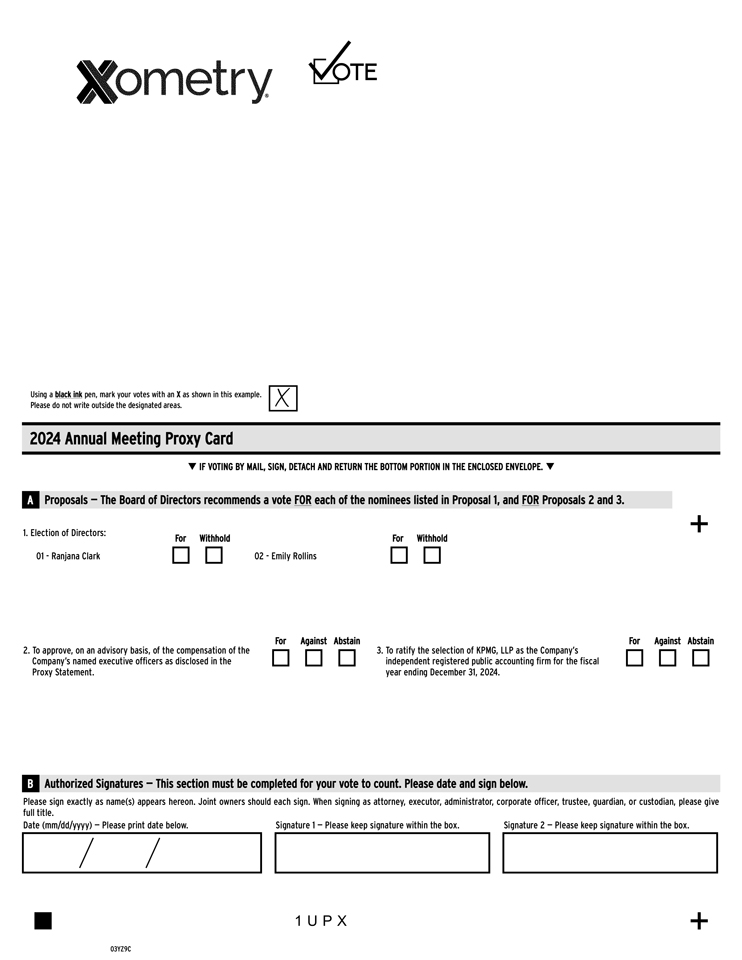

There are fourthree matters scheduled for a vote:

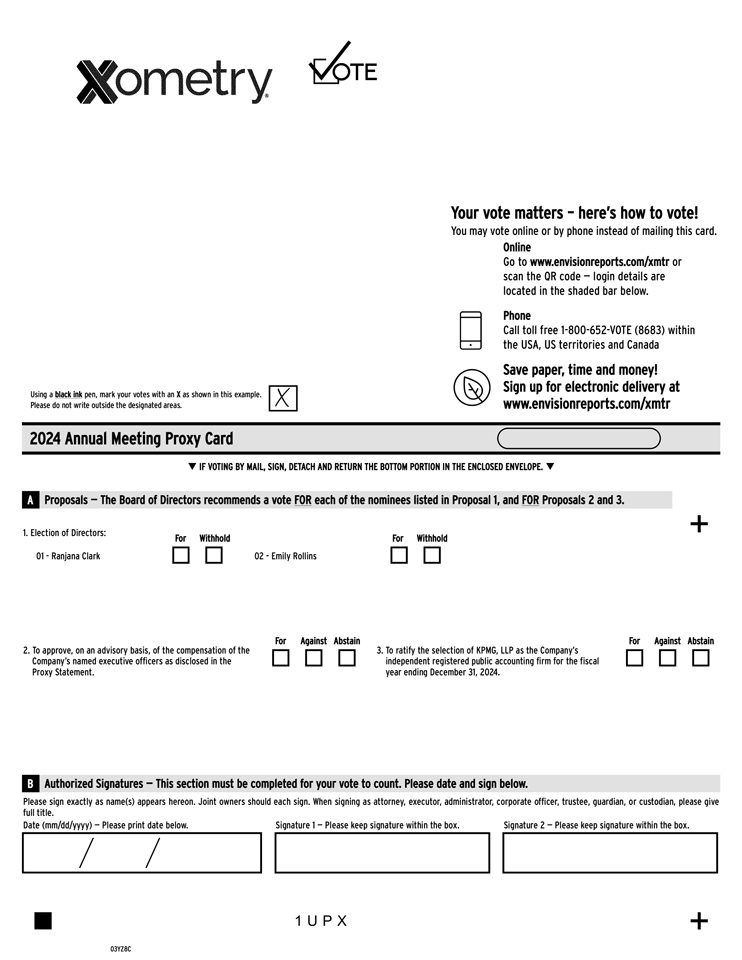

Proposal 1: Election of the Board of Directors’ threetwo nominees for Class IIIII directors, George Hornig, Fabio RosatiRanjana Clark and Katharine Weymouth,Emily Rollins, each to hold office until our Annual Meeting of Stockholders in 2026;2027;

3

Proposal 2: Advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules;

Proposal 3: Advisory indication of the preferred frequency of stockholder advisory votes on the compensation of our named executive officers; and

Proposal 4: Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024.

3

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the proxies will vote as recommended by the Board or, if no recommendation is given, will vote on those matters in accordance with their best judgment.

How do I vote?

For Proposal 1, you may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee to the Board that you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and your shares are registered directly in your name, you may vote (i) online during the Annual Meeting or (ii) in advance of the Annual Meeting by proxy through the Internet, by telephone or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote online even if you have already voted by proxy.

| • | Online during the Annual Meeting. You will be able to attend the Annual Meeting online and vote during the meeting by visiting https://meetnow.global/ |

| • | By Internet in advance of the Annual Meeting. Go to www.envisionreports.com/XMTR to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. |

| • | By Telephone in advance of the Annual Meeting. Call 1-800-652-VOTE (8683) toll-free from the U.S., U.S. territories and Canada, and follow the instructions on the Notice of Internet Availability. You will be asked to provide your control number from the Notice of Internet Availability. |

| • | By Proxy Card in advance of the Annual Meeting. Complete, sign and mail the proxy card that may be delivered and return it promptly in the envelope provided. Proxy cards submitted by mail must be received by 5:00 p.m., Eastern Time, on June |

Internet and telephone voting facilities for stockholders of record will be available for 24 hours a day and will close when our polls close during the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares of common stock are held in street name (i.e., held for your account by a broker, bank or other nominee), you should have received a notice containing voting instructions from that organization rather than from us. You should follow the instructions in the notice to ensure your vote is counted. Alternatively, many brokers and banks provide the means to grant proxies or otherwise instruct them to vote your shares by telephone and via the internet, including by providing you with a control number via email or on notice or your voting

4

instruction form. If your shares are held in an account with a broker, bank or other stockholder of record providing such a service, you may instruct them to vote your shares by telephone (by calling the number provided in the Proxy Materials) or over the internet as instructed by your broker, bank or other stockholder of record. If you aredid not receive a control number via email or on your notice or voting instruction form, and you wish to vote prior to or at the virtual Annual Meeting, you must follow the instructions from your broker, bank or other stockholder of record, including any requirement to obtain your control number. Many brokers, banks and other stockholders of record allow a beneficial owner to obtain their control number either online or by mail, and would likewe recommend that you contact your broker, bank or other stockholder of record to vote online during the Annual Meeting you should follow the procedures outlined above.do so.

Internet voting during the Annual Meeting and/or Internet proxy voting in advance of the Annual Meeting allows you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your vote instructions. Please be aware that you must bear any costs associated with your Internet access. |

How many votes do I have?

Each holder of shares of our Class A common stock will have one vote per share of Class A common stock held as of the Record Date, and each holder of shares of our Class B common stock will have twenty votes per share of Class B common stock held as of the Record Date. The holders of the shares of our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited.

4

What are the Board’s recommendations on how to vote my shares?

The Board recommends a vote:

| • | Proposal 1: FOR the election of the Board’s |

| • | Proposal 2: FOR the approval of the advisory vote on the compensation of our named executive officers; |

| • | Proposal 3: |

|

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or online during the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the election of each of the threetwo nominees named in this proxy statement for director, “FOR” the advisory approval of the compensation of our named executive officers, for “1 YEAR” as the preferred frequency of advisory votes to approve the compensation of our named executive officers, and “FOR” the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using such proxyholder’s best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether, pursuant to stock exchange rules, the particular proposal is deemed to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under applicable rules and

5

interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation, and certain corporate governance proposals, even if management-supported. In this regard, Proposals 1 2 and 32 are considered to be “non-routine” under applicable rules, meaning your broker or nominee may not vote your shares on Proposals 1 2 or 32 without your instructions. Such an event would result in a “broker non-vote” and these shares will not be counted as having been voted for such proposals. However, Proposal 3 is considered to be a “routine” matter, meaning that if you do not return voting instructions to your broker or nominee by its deadline, your broker or nominee may vote your shares in its discretion on Proposal 4.3.

If you are a beneficial owner of shares held in street name, to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other nominee.

What does it mean if I receive more than one Notice of Internet Availability?

If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each notice to ensure that all of your shares are voted.

5

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. If you are the stockholder of record for your shares, you may revoke your proxy at any time before the final vote at the Annual Meeting in one of the following ways:

by submitting another properly completed proxy with a later date;

by transmitting a subsequent vote over the Internet or by telephone prior to the start of the Annual Meeting;

by sending a timely written notice to our Secretary in writing at Xometry, Inc., 6116 Executive Boulevard, Suite 800, North Bethesda, Maryland 20852 received by the close of business on the business day one week preceding the date of the Annual Meeting that you are revoking your proxy; or

| • | by attending the Annual Meeting via the live webcast and voting your shares online by clicking on the “Cast Your Vote” link in the meeting center at https://meetnow.global/ |

Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If your shares are held in street name, you must contact your broker or nominee for instructions as to how to change your vote. Your personal attendance at the Annual Meeting does not revoke your proxy. Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

How is a quorum reached?

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person, by remote communication, if applicable, or by proxy duly authorized, of the holders of a majority of the voting power of the outstanding shares entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business. The inspector(s) of election appointed for the Annual Meeting will determine whether or not a quorum is present.

In the absence of a quorum, any meeting of stockholders may be adjourned, from time to time, either by the chairperson of the meeting or by vote of the holders of a majority of the voting power of the shares represented thereat and entitled to vote thereon, but no other business shall be transacted at such meeting.

6

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count: (1) with respect to Proposal 1, votes “FOR,” “WITHHOLD” and broker non-votes, (2) with respect to Proposal 2, votes “FOR,” “AGAINST,” abstentions and broker non-votes, and (3) with respect to Proposal 3, votes for a frequency vote of “ONE”, “TWO”, or “THREE” years, abstentions and broker non-votes and (4) with respect to Proposal 4, votes “FOR,” “AGAINST” and abstentions. Abstentions will not be counted towards the vote total and have no effect on Proposals 2 3, and 4.3. Broker non-votes have no effect and will not be counted towards the vote total for Proposals 1 2 and 3.2.

What are “broker non-votes”?

As discussed above, broker non-votes occur when your broker submits a proxy for the meeting with respect to “routine” matters but does not vote on “non-routine” matters because you did not provide voting instructions on those matters. Proposals 1 2 and 32 are considered to be “non-routine,” and we therefore expect broker non-votes to exist only in connection with these proposals.

6

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

What vote is required to approve each item and how are votes counted?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes:

Proposal | Vote Required for Approval | Effect of Abstentions | Effect of Votes | |||

| 1. Election of Directors | The | Not applicable | No effect | |||

| 2. Advisory Vote to Approve Compensation of Our Named Executive Officers | This proposal, commonly referred to as the “say-on-pay” vote, must receive “FOR” votes from the holders of a majority of the voting power of the shares present in person, by remote communication, if applicable, or represented by proxy duly authorized at the meeting and voting affirmatively or negatively (excluding abstentions and broker non-votes) on such matter. | No effect | No effect | |||

| 3. | ||||||

| This proposal must receive “FOR” votes from the holders of a majority of the voting power of the shares present in person, by remote communication, if applicable, or represented by proxy duly authorized at the meeting and voting affirmatively or negatively (excluding abstentions and broker non-votes) on such matter. | No effect | Not applicable | ||||

7

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at our Annual Meeting. We will publish final voting results in a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available at that time, we will disclose the preliminary results in the Current Report

7

on Form 8-K and, within four business days after the final voting results are known to us, file an amended Current Report on Form 8-K to disclose the final voting results.

Who pays the cost for soliciting proxies?

We will pay the entire cost of soliciting proxies. In addition to these Proxy Materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

When are stockholder proposals due for the 20242025 Annual Meeting of Stockholders?

If you wish to submit proposals for inclusion in our proxy statement for the 20242025 Annual Meeting of Stockholders (the “2024“2025 Annual Meeting”), we must receive them on or before December 30, 2023.2024. Nothing in this paragraph shall require us to include in our proxy statement or proxy card for the 20242025 Annual Meeting any stockholder proposal that does not meet the requirements of the SEC in effect at the time. Any such proposal will be subject to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, stockholders who intend to solicit proxies in support of director nominees other than our nominees must also comply with the additional requirements of Rule 14a-19(b) of the Exchange Act.

If you wish to nominate a director or submit a proposal for presentation at the 20242025 Annual Meeting, without including such proposal in next year’s proxy statement, you must be a stockholder of record and provide timely notice in writing to our Secretary at Xometry, Inc., 6116 Executive Boulevard, Suite 800, North Bethesda, Maryland 20852. To be timely, we must receive the notice not less than 90 days nor more than 120 days prior to the first anniversary of the Annual Meeting, that is, between February 21, 202418, 2025 and March 22, 2024;20, 2025; provided, however, that in the event that the date of the 20242025 Annual Meeting is more than 30 days before or more than 30 days after such anniversary date, we must receive your notice (a) no earlier than the close of business on the 120th day prior to the 20242025 Annual Meeting and (b) no later than the close of business on the later of the 90th day prior to the 20242025 Annual Meeting or the close of business on the 10th day following the day on which we first make a public announcement of the date of the 20242025 Annual Meeting. Your written notice must contain specific information required in Section 5 of our amended and restated bylaws (the “Bylaws”). For additional information about our director nomination requirements, please see our Bylaws.

Who should I call if I have any additional questions?

If you are the stockholder of record for your shares, please call Shawn Milne, our Vice President of Investor Relations, at 240.335.8132 or email shawn.milne@xometry.com. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

8

PROPOSAL 1: ELECTION OF DIRECTORS

General

Our Board is currently composed of eightseven directors and is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors and has a three-year term. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election.

Our directors are divided into three classes as follows:

Class II directors: George Hornig, Fabio Rosati and Katharine Weymouth, whose terms will expire at the upcoming Annual Meeting;

Class III directors: Ranjana Clark, Emily Rollins and Laurence Zuriff, whose terms will expire at the upcoming Annual Meeting of Stockholders to be held in 2024;Meeting; and

Class I directors: Randolph Altschuler and Deborah Bial, whose terms will expire at the Annual Meeting of Stockholders to be held in 2025.2025; and

Class II directors: Fabio Rosati and Katharine Weymouth, whose terms will expire at Annual Meeting of Stockholders to be held in 2026.

On April 8, 2024, Mr. Zuriff notified the Board that he will not stand for reelection as a director of Xometry upon expiration of his current term at the Annual Meeting due to health reasons, and not as a result of any disagreement between Mr. Zuriff and Xometry, its management, our Board (or any committee thereof), or with respect to any matter relating to our operations, policies or practices. Upon the recommendation of the Nominating and Corporate Governance Committee, our Board has nominated Mses. Clark and Rollins for election as directors at the Annual Meeting. Effective upon the expiration of Mr. Zuriff’s term at the Annual Meeting, the Board has reduced the size of the Board from seven to six directors.

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company.

Each of Mr. Hornig, Mr. RosatiMses. Clark and Ms. WeymouthRollins is currently a member of our Board. Mr. Hornig and Ms. Weymouth were previously elected toClark was appointed by the Board byin July 2021 effective immediately upon the stockholders prior toconsummation of our initial public offering (“IPO”) of Class A common stock. Mr. RosatiMs. Rollins was appointedpreviously elected to the Board by the Boardstockholders in March 2021 prior to our IPO to fill a vacancy on the Board. Each of these nominees hasMses. Clark and Rollins have been nominated for reelection to serve as a Class IIIII director, based in part on the recommendation of the Nominating and Corporate Governance Committee, and had agreed to be named in this proxy statement and stand for reelection at the Annual Meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the Annual Meeting, each of these nominees would serve until the Annual Meeting of Stockholders to be held in 20262027 and until the director’s successor has been duly elected, or if sooner, until the director’s death, resignation or removal.

Vote Required

Directors are elected by a plurality of the votes of the holders of shares present or represented by proxy and entitled to vote on the election of directors. Accordingly, the threetwo nominees receiving the highest number of “FOR” votes will be elected. You may not vote your shares cumulatively for the election of directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the threetwo nominees named above. If any nominee becomes unavailable for election as a result of an unexpected

occurrence, your shares will be voted for the election of a substitute nominee proposed by our Board. The Board

9

has no reason to believe that any of the nominees would prove unable to serve if elected. There are no arrangements or understandings between us and any nominee for directorship, pursuant to which such person was selected as a nominee.

The biographies below under “Information Regarding Director Nominees and Current Directors” include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director nominee that led the Nominating and Corporate Governance Committee to believe that the nominee should continue to serve on the Board. However, each of the members of

9

the Nominating and Corporate Governance Committee may have a variety of reasons why a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

Our Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH CLASS IIIII DIRECTOR NOMINEE NAMED ABOVE.

10

INFORMATION ABOUT OUR DIRECTOR NOMINEES AND CURRENT DIRECTORS

The following table sets forth, for the Class IIIII nominees and our other directors who will continue in office after the Annual Meeting, their ages and position or office held with us as of the date of this proxy statement.

Name | Age | Position | Director Since | Age | Position | Director Since | Class II director nominees for election at the 2023 Annual Meeting of Stockholders | |||||

| George Hornig | 68 | Director and Chair of the Board | 2013 | |||||||||

| Class III director nominees for election at the 2024 Annual Meeting of Stockholders | Class III director nominees for election at the 2024 Annual Meeting of Stockholders | |||||||||||

| Ranjana Clark | 63 | Director | 2021 | |||||||||

| Emily Rollins | 54 | Director | 2021 | |||||||||

| Class II directors continuing in office until the 2026 Annual Meeting of Stockholders | Class II directors continuing in office until the 2026 Annual Meeting of Stockholders | |||||||||||

| Fabio Rosati | 58 | Director | 2017 | 59 | Director and Chair of the Board | 2017 | ||||||

| Katharine Weymouth | 56 | Director | 2020 | 57 | Director | 2020 | Class III directors continuing in office until the 2024 Annual Meeting of Stockholders | |||||

| Ranjana Clark | 62 | Director | 2021 | |||||||||

| Emily Rollins | 53 | Director | 2021 | |||||||||

| Laurence Zuriff | 55 | Co-Founder, Managing Director of Donor Advised Fund, and Director | 2013 | |||||||||

| Class I directors continuing in office until the 2025 Annual Meeting of Stockholders | Class I directors continuing in office until the 2025 Annual Meeting of Stockholders | Class I directors continuing in office until the 2025 Annual Meeting of Stockholders | ||||||||||

| Randolph Altschuler | 52 | Co-Founder, Chief Executive Officer and Director | 2013 | 53 | Co-Founder, Chief Executive Officer and Director | 2013 | ||||||

| Deborah Bial | 57 | Director | 2020 | 58 | Director | 2020 | ||||||

Set forth below is biographical information for the director nominees and each person whose term of office as a director will continue after the Annual Meeting. This includes information regarding each director’s experience, qualifications, attributes or skills that led the Board to recommend them for board service.

Nominees for Election at the 2023 Annual Meeting of Stockholders

George Hornighas served as a member of our Board since October 2013 and as chair of our board of directors since March 2021. Mr. Hornig serves as the Managing Partner and is a co-founder of The Seed Lab, an entrepreneur-led early-stage venture fund, a position he has held since November 2018. Mr. Hornig served as the Senior Managing Director and Chief Operating Officer of PineBridge Investments, a private, global asset manager, from November 2010 to December 2016. Mr. Hornig currently serves as the co-chair of the board of directors of Healthwell Acquisition Corp. I and as a member of the board of directors of Vaxxinity, Inc., positions he has held since July 2021 and January 2022, respectively. Mr. Hornig served as chair of the board of directors of KBL Merger Corp. IV from April 2017 to August 2020. From November 1996 to May 2018, he also served on the board of directors of Forrester Research and as chair of its audit committee. Mr. Hornig received an A.B. in Economics from Harvard University, a J.D. from Harvard Law School and an M.B.A from Harvard Business School.

Fabio Rosatihas served as a member of our Board since December 2017. Mr. Rosati is the Executive Chairman of Snagajob, a marketplace platform for connecting businesses with hourly workers, a position he has held since June 2019. He has been a member of the board of directors of Snagajob since 2017 and held the position of Chairman and acting CEO from July 2018 to May 2019. From May 2015 to July 2017 he served on the board of directors of Upwork, a position he held after serving as CEO from January 2014 to April 2015. Mr. Rosati is a board member of Smith.ai. Mr. Rosati received a B.S. in Finance and Accounting from Georgetown University.

Katharine Weymouthhas served as a member of our Board since October 2020. Since September 2021, Ms. Weymouth has served as the Chief Operating Officer at Shine Together (formerly known as FamilyCare), a start-up in the mental health space. Ms. Weymouth previously served as a senior advisor to ChefMarket (formerly DineXpert), a platform helping independent restaurants and food businesses source high quality products, and previously served as its Chief Operating Officer and President from June 2017 until May 2021.

11

Ms. Weymouth was the Publisher and Chief Executive Officer of the Washington Post from February 2008 to September 2014. Since January 2015, Ms. Weymouth has served as a Trustee of the Philip L Graham Fund and the Greater Washington Community Foundation. Ms. Weymouth is a board member of Republic Services, Inc, Cable One, Inc., Sequoia Fund, Inc., and The Graham Holdings Company. Ms. Weymouth received a B.A. in English Literature from Harvard University and a J.D. from Stanford Law School.

Directors Continuing in Office until the 2024 Annual Meeting of Stockholders

Ranjana Clark has served as a member of our Board since July 2021. From July 2013 to March 2023, Ms. Clark held a number of positions with Mitsubishi UFJ Financial Group (“MUFG”), most recently as its Head of Global Transaction Banking, Head of Transaction Banking Americas and Bay Area President. Prior to joining MUFG, Ms. Clark was the Chief Customer and Marketing Officer at PayPal from May 2011 to June 2013. Prior to that, Ms. Clark spent over 25 years in the financial services industry in roles spanning payments, marketing, strategy and business leadership. Ms. Clark currently serves on the board of directors of StanCorp Financial Group, Inc. and InvestCloud, Inc., positions she has held since July 2014 and May 2022, respectively. Ms. Clark is also a member of the President’s Leadership Council, Asia Foundation.Foundation and a fellow at Stanford University’s Distinguished Careers Institute. Ms. Clark received a B.A. from the University of Delhi, an M.B.A. with an emphasis in Marketing from the Indian Institute of Management, Ahmedabad and an M.B.A with an emphasis in Finance from Duke University’s Fuqua School of Business. We believe Ms. Clark is qualified to serve on our Board due to her extensive executive experience and deep knowledge of the financial services industry.

Emily Rollins has served as a member of our Board since March 2021. From September 1992 to September 2020, Ms. Rollins served in various positions at Deloitte & Touche LLP including most recently as an Audit & Assurance Partner. She currently serves on the board of directors and as chair of the audit committee of Dolby Laboratories, Inc., a position she has held since February 2021, as well as on the board of directors and as chair of the audit committee of Science 37 Holdings Inc., a position she has held since October 2021. Ms. Rollins also currently serves on the boards of directors of several private companies, as well as the Austin chapter of Ascend Leadership, the Greater Austin Black Chamber of Commerce and the Austin Healthcare Council. Ms. Rollins previously served on the board of directors of McAfee Corp. from October 2021 until its acquisition in March 2022.2022 and Science 37 Holdings, Inc. until its acquisition in March 2024. Ms. Rollins is a managing member of 3E & J LLC. Ms. Rollins holds a B.A. degree in Accounting and International Relations from Claremont McKenna College. We believe that Ms. Rollins is qualified to serve on our Board due to her board and management experience with complex audit and reporting processes for technology and media companies.

11

Directors Continuing in Office until the 2026 Annual Meeting of Stockholders

Laurence ZuriffFabio Rosati is our co-founder, served as our Chief Strategy Officer from April 2020 until March 2023, currently manages our donor advised fund and environmental, social and governance activities, and has served as a member of our Board since December 2017 and as chair of our Board since December 2023. Mr. Rosati served on the board of directors from 2017 through November 2023 at Snagajob, a marketplace platform for connecting businesses with hourly workers. At Snagajob Mr. Rosati was Chair of the Board from November 2022 through November 2023, Executive Chairman from June 2019 through October 2022, and Chairman and acting CEO from July 2018 to May 2013. He also previously2019. From May 2015 to July 2017 he served on the board of directors of Upwork, a position he held after serving as our Chief Financial OfficerCEO from September 2013January 2014 to April 2020. Prior to co-founding Xometry,2015. Mr. Zuriff was the managing partner at Granite Capital International Group. Prior to Granite, Mr. Zuriff was a managing director and technology analyst at Weiss, Peck & Greer. Mr. Zuriff began his career as an analyst at Science Applications International Corporation and in the Office of Net Assessment at the Department of Defense. Mr. ZuriffRosati is a board member of Smith.ai. Mr. Rosati received a B.S. in Finance and chairsAccounting from Georgetown University. We believe that Mr. Rosati is qualified to serve on the audit committeeBoard because of his experience in the technology space.

Katharine Weymouthhas served as a member of our Board since October 2020. Since September 2021, Ms. Weymouth has served as the Chief Operating Officer at Shine Together (formerly known as FamilyCare), a start-up in the mental health space. Ms. Weymouth previously served as a senior advisor to ChefMarket (formerly DineXpert), a platform helping independent restaurants and food businesses source high quality products, and previously served as its Chief Operating Officer and President from June 2017 until May 2021. Ms. Weymouth was the Publisher and Chief Executive Officer of the Washington-based Center for StrategicWashington Post from February 2008 to September 2014. Since January 2015, Ms. Weymouth has served as a Trustee of the Philip L Graham Fund and Budgetary Analysis. Mr. Zuriffthe Greater Washington Community Foundation. Ms. Weymouth is a board member of Republic Services, Inc, Cable One, Inc., Sequoia Mutual Fund, Inc., and The Graham Holdings Company. Ms. Weymouth received a B.A. in International RelationsEnglish Literature from BrownHarvard University and an M.A. in Strategic Studiesa J.D. from Stanford Law School. We believe that Ms. Weymouth is qualified to serve on the Board because of her extensive executive and Economics from The John Hopkins University.public company board experience.

Directors Continuing in Office until the 2025 Annual Meeting of Stockholders

Randolph Altschuler is our co-founder and has served as our Chief Executive Officer and as a member of our Board since May 2013. Prior to co-founding Xometry, Mr. Altschuler served as the co-founder and Executive Chairman of CloudBlue Technologies, Inc., a provider of recycling services for electronic equipment, from January 2008 to September 2013. Prior to CloudBlue, Mr. Altschuler was the co-founder and Co-Chief Executive Officer of OfficeTiger, Inc., a global business process outsourcing company, from 2000 to 2007. Mr. Altschuler received a B.A. from Princeton University and an M.B.A. from Harvard Business School. Mr. Altschuler was awarded a Fulbright Scholarship and studied at the University of Vienna in Austria. We believe that Mr. Altschuler is qualified to serve on the Board because of his experience building and leading our business since inception.

Deborah Bial has served as a member of our board of directors since October 2020. Ms. Bial is the founder and president of the Posse Foundation, a diversity, leadership development and college success organization, a

12

position she has held since 1989. In 2007, Ms. Bial received a prestigious MacArthur “Genius” Fellowship from the John D. and Catherine T. MacArthur Foundation. Ms. Bial received a B.A. from Brandeis University and an Ed.M and Ed.D. from Harvard University, and she is a member of Brandeis’ Board of Trustees. We believe that Ms. Bial is qualified to serve on the Board because of her extensive experience and leadership abilities.

Board Diversity

Our Board believes that a diverse board is better able to effectively oversee our management and strategy, and position our company to deliver long-term value for our stockholders. Our Nominating and Corporate Governance Committee considers diversity, including diversity of gender, ethnic background and country of origin, as adding to the overall mix of perspectives of the Board as a whole. With the assistance of the Nominating and Corporate Governance Committee, the Board regularly reviews trends in board composition, including on director diversity.

12

The table below provides additional diversity information regarding our board of directors as of April 28, 2023.2024. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Listing Rule 5605(f).

Board Diversity Matrix (as of April 28, 2023) | ||||||||||||||||||||||||||||||||

Board Diversity Matrix (as of April 28, 2024) | Board Diversity Matrix (as of April 28, 2024) | |||||||||||||||||||||||||||||||

Board Size: | Board Size: |

| Board Size: |

| ||||||||||||||||||||||||||||

Total Number of Directors | 8 | 7 | ||||||||||||||||||||||||||||||

|

| Female | Male | Non-Binary | Did Not Disclose Gender | Female | Male | Non-Binary | Did Not Disclose Gender | ||||||||||||||||||||||||

Gender: |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

Directors | 4 | 4 | 0 | 0 | 4 | 3 | 0 | 0 | ||||||||||||||||||||||||

Number of Directors who identify in any of the categories below: | Number of Directors who identify in any of the categories below: |

|

|

|

| Number of Directors who identify in any of the categories below: |

|

|

|

| ||||||||||||||||||||||

Asian | 2 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | ||||||||||||||||||||||||

White | 2 | 4 | 0 | 0 | 2 | 3 | 0 | 0 | ||||||||||||||||||||||||

LGBTQ+ | 0 | 0 | ||||||||||||||||||||||||||||||

Did Not Disclose Demographic Background | 0 | 0 | ||||||||||||||||||||||||||||||

Our Board Diversity Matrix as of May 2, 2022April 28, 2023 can be found in our proxy statement for the 20222023 Annual Meeting, filed with the SEC on May 2, 2022.April 28, 2023.

13

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Board Independence

As required under The Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with our counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Based on information provided by each director concerning such director’s background, employment, affiliations, all relevant identified transactions or relationships between each director or any of such director’s family members, and Xometry, our senior management and our independent auditors, the Board has affirmatively determined that Mses. Bial, Clark, Rollins and Weymouth and Mr. Rosati are “independent” in accordance with the Nasdaq listing standards applicable to boards of directors in general, and George Hornig, who left our board in December 2023 was “independent” during the period he served on the Board during 2023. The Board also determined that each member of our Audit, Compensation and Nominating and Corporate Governance Committees satisfies the independence standards for such committees established by the SEC and the Nasdaq listing standards, as applicable.

In making this determination, the Board found that none of ourthese current directors or former directors who served on our Board in 2022, other than Mr. Altschuler and Mr. Zuriff, by virtue of their respective positions as Chief Executive Officer and Managing Director of our Donor Advised Fund and shared status as our co-founders, has or had any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each of these directors is “independent” as that term is defined under the Nasdaq listing standards. In making these determinations, our Board consideredtaking into account the current and prior relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-employee director and the transactions described in the section titled “Transactions with Related Persons.” The Board also determined that each memberMessrs. Altschuler and Zuriff, by virtue of their respective positions as Chief Executive Officer and Managing Director of our Audit, CompensationDonor Advised Fund and Nominating and Corporate Governance Committees satisfies the independence standards for such committees established by the SEC andshared status as our co-founders, are not “independent” under the Nasdaq listing standards, as applicable.standards.

Board Leadership Structure

The Board has an independent chair, Mr. Rosati (and Mr. Hornig before he left the Board in December 2023), who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board chair has substantial ability to shape the work of the Board. We believe that separation of the positions of Board chair and Chief Executive Officer reinforces the independence of the Board in its oversight of our business and affairs. In addition, we believe that having an independent Board chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of Xometry and our stockholders. As a result, we believe that having an independent Board chair can enhance the effectiveness of the Board as a whole.

Our Corporate Governance Guidelines specify that the Board will select our Chief Executive Officer and chairperson of the Board in the manner that it determines to be in the best interests of our stockholders and in accordance with any stockholder agreements. The Board does not believe there should be a fixed rule regarding the positions of Chief Executive Officer and chairperson being held by different individuals, or whether the chairperson should be a Xometry employee or should be elected from among the non-employee directors. The needs of Xometry and the individuals available to assume these roles may require different outcomes at different times, and the Board believes that retaining flexibility in these decisions is in the best interests of Xometry.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the

14

Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for our company.

14

Our Audit Committee has the responsibility to consider and discuss with management and the auditors, as appropriate, our guidelines and policies with respect to financial risk management and financial risk assessment, including our major financial risk exposures and the steps taken by management to monitor and control these exposures. In addition, the Audit Committee considers management risks relating to data privacy, technology and information security, including cyber security, and back-up of information systems and the steps we have taken to monitor and control such exposures as well as overseeing the performance of our internal audit function, as applicable. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, including risks related to executive compensation and overall compensation and benefit strategies, plans, arrangements, practices and policies. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Nominating and Corporate Governance Committee also oversees and reviews with management our major legal compliance risk exposures and the steps management has taken to monitor or mitigate such exposures, including our procedures and any related policies with respect to risk assessment and risk management. Our Environmental and Social Governance Committee provides oversight for our strategies, policies and practices related to environmental, governance and human capital matters.

It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. In connection with its reviews of our operations and corporate functions, our Board addresses the primary risks associated with those operations and corporate functions. In addition, our Board reviews the risks associated with our business strategies periodically throughout the year as part of its consideration of undertaking any such business strategies. While the Board and its committees oversee risk management strategy, management is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees on such matters.

Board Meetings and Attendance

The Board oversees our business and monitors the performance of our management. Our executive officers and management oversee our day-to-day operations. Our Board held eightnine meetings during 2022.2023. Each director attended at least 75% of the total of the meetings of the Board and committees of the Board on which such director served during 20222023 (in each case, which were held during the period for which he or she was a director and/or a member of the applicable committee). It is our policy to encourage our directors to attend the Annual Meeting. All members of the Board but onetwo attended the 20222023 Annual Meeting of Stockholders, and we anticipate that all members of the Board will attend the upcoming Annual Meeting.

The independent directors of the Board meet quarterly in executive sessions without management or any non-independent directors. The purpose of these executive sessions is to promote open and candid discussion among the non-employee directors. In 2022,2023, our independent directors met fourseven times in regularly scheduled executive sessions at which only independent directors were present.

15

Board Committees

Our Board has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, and an Environmental and Social Governance Committee. The following table provides committee membership as of the date of this proxy statement and meeting information for 2022 for each of the committees:standing committees of the Board:

| Name | Audit | Compensation | Nominating & | |||

| Deborah Bial | X | X | ||||

| Ranjana Clark | X(1) | X | ||||

| Craig Driscoll | X(1) | |||||

| George Hornig | X | X | ||||

| Emily Rollins | X†* | |||||

| Fabio Rosati | X* | X | ||||

| Katharine Weymouth | X | X* | ||||

| Total meetings in 2022 | 4 | 5 | 3 |

15

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Environmental and Social Governance Committee | ||||

| Deborah Bial | X | X | X* | |||||

| Ranjana Clark | X | X | X | |||||

| Emily Rollins | X†* | X | ||||||

| Fabio Rosati | X* | X | ||||||

| Katharine Weymouth | X | X* | ||||||

| Laurence Zuriff | X | |||||||

| Total meetings in 2023 | 5 | 8 | 2 | 6 |

| † | Financial Expert |

| * | Committee Chair |

|

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. Each of the committees operates pursuant to a written charter and each committee reviews and assesses the adequacy of its charter and submits its charter to the Board for approval. The charters are all available in the “Investors–Corporate Governance” section of our website, www.xometry.com. The inclusion of our website address here and elsewhere in this proxy statement does not include or incorporate by reference the information on our website into this proxy statement.

Audit Committee

Our Audit Committee consists of George Hornig,Ranjana Clark, Emily Rollins and Katharine Weymouth, with Ms. Rollins serving as Chair of the committee. In addition, George Hornig served on the Audit Committee until his departure from the Board in December 2023, at which time Ms. Clark was appointed to the Audit Committee. The Board has determined that Ms. Rollins is an “audit committee financial expert” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, our Board has examined each Audit Committee member’s scope of experience and the nature of their employment in the corporate finance sector.

The primary purpose of the Audit Committee is to discharge the responsibilities of our Board with respect to our corporate accounting and financial reporting processes, systems of internal control and financial statement audits, and to oversee our independent registered public accounting firm. Specific responsibilities of our Audit Committee include:

overseeing the integrity of our financial statements and our accounting and financial reporting processes and financial statement audits;

overseeing the registered public accounting firm’s (independent auditor’s) qualifications and independence;

overseeing the performance of our independent auditor and internal audit function;

overseeing our systems of disclosure controls and procedures;

overseeing our internal controls over financial reporting; and

overseeing our compliance with ethical standards adopted by us.

16

Report of the Audit Committee

The primary purpose of the Audit Committee is to oversee Xometry’s financial reporting processes on behalf of the Board. The Audit Committee’s functions are more fully described in its charter, which is available in the Corporate Governance section of Xometry’s website. Management has the primary responsibility for Xometry’s financial statements and reporting processes, including Xometry’s systems of internal controls.

The Audit Committee has reviewed and discussed the audited financial statements as of and for the fiscal year ended December 31, 20222023 with management of Xometry. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by

16

applicable requirements of the PCAOB regarding the independent accountants’registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee recommended to the Board that the audited financial statements be included in Xometry’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.2023.

Xometry, Inc.

Audit Committee

Emily Rollins (chair)

George HornigRanjana Clark

Katharine Weymouth

The material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing of Xometry under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation Committee

Our Compensation Committee consists of Deborah Bial, Ranjana Clark George Hornig and Fabio Rosati, with Mr. Rosati serving as Chair of the committee. In addition, Craig Driscoll, a former member of the Board,George Hornig served on the Compensation Committee until his departure from the Board in June 2022.December 2023. Our Board has determined that each member of the Compensation Committee is independent under the Nasdaq listing standards and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

The primary purpose of our Compensation Committee is to discharge the responsibilities of our Board in overseeing our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. Specific responsibilities of our Compensation Committee include:

helping the Board oversee our compensation policies, plans and programs with a goal to attract, incentivize, retain and reward top quality executive management and employees;

reviewing and determining the compensation to be paid to our executive officers and directors;

reviewing and discussing with management our compensation disclosures in the “Compensation Discussion and Analysis” section of our annual reports, registration statements, proxy statements or information statements filed with the SEC; and

preparing and reviewing the Compensation Committee’s report on executive compensation included in our annual proxy statement.

17

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with our Chief Executive Officer and our Chief People Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisers or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all

17

books, records, facilities and personnel of Xometry. In addition, under the charter, the Compensation Committee has the authority to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal, accounting or other advisers and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after assessing the independence of such person in accordance with SEC and Nasdaq requirements that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is currently one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Report of the Compensation Committee of the Board of Directors

The compensation committeeCompensation Committee has reviewed and discussed the section of this proxy statement titled “Compensation Discussion and Analysis” with management. Based on such review and discussion, the compensation committeeCompensation Committee has recommended to the board of directors that the section titled “Compensation Discussion and Analysis” be included in this proxy statement and incorporated into Xometry’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.2023.

Xometry, Inc.

Compensation Committee

Fabio Rosati (chair)

Deborah Bial

Ranjana Clark

George Hornig

The material in this report is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not deemed to be incorporated by reference in any filing of Xometry under the Securities Act or the Exchange Act, other than Xometry’s Annual Report on Form 10-K, where it shall be deemed to be “furnished,” whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

18

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Deborah Bial, Ranjana Clark, Fabio Rosati and Katharine Weymouth, with Ms. Weymouth serving as Chair of the committee.

The primary purpose of the Nominating and Corporate Governance Committee is to discharge the responsibilities of our board of directors with respect to our corporate governance functions and to identify, communicate with, evaluate and recommend candidates for our Board. Specific responsibilities of our Nominating and Corporate Governance Committee include:

helping the Board oversee our corporate governance functions and develop, update as necessary and recommend to the Board the governance principles applicable to Xometry;

18

identifying, evaluating and recommending and communicating with candidates qualified to become Board members or nominees for directors of the Board consistent with criteria approved by the Board; and